Step by Step Process of Importing a Vehicle in Cambodia

Here are steps involved in Importing Vehicle in Cambodia:

- Hire an import company to do custom clearance and import license. If you choose to do it yourself you are required to pay 20% of import duty as a penalty. Most import companies charge 2% of cargo value or a minimum of US$150 for their services so most people prefer importing through them. Since they also have knowledge of duties imposed on earlier vehicle imports and have good relations with Custom you are assured that there won't be any nasty surprises

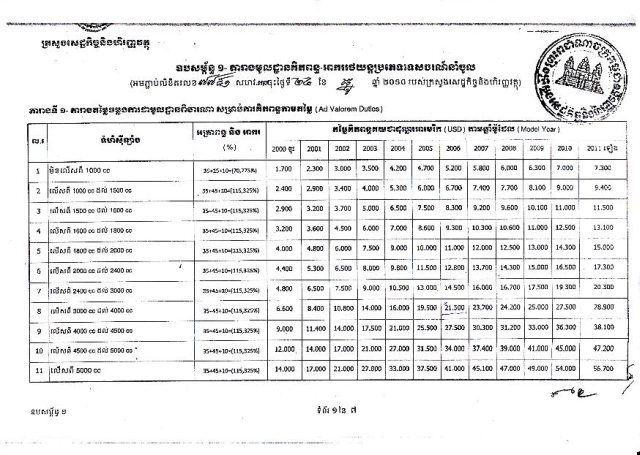

- Find out the assessed value of the car you are planning to import. The customs code does not do this by make, mileage and market value but uses an ‘arbitrary’ value as the basis for their computation of any duty and tax due on the vehicle. The customs code uses the engine displacement and the year. Here is the schedule:

- The ad valorum duty and tax can be found in this schedule. The 35% is the import duty, the 45% is the excise tax (I call it the luxury tax), and the 10% is the added value tax. These rates are compounded so that the total will be 115.325%.